Affording College?

May 26, 2020

Written by Logan Cummings|

Photos by Logan Cummings|

With the school year coming to an end, it’s time for a new wave of students to enter into colleges and universities to attain a higher education. While delving into a specific field of interest prepares students to get a job in the future, education comes with a hefty financial burden. Considering the majority of graduating students plan on going to college, the cost of that education has a widespread impact.

When choosing a school, students cannot just consider the quality of education or the location. Oftentimes, it’s a choice between spending $70,000 a year or spending $40,000 a year. Students are faced with taking out loans that follow them for years after graduation, and after adding interest, the cost increases significantly. Some loans don’t accrue interest during students’ time at school, making them much easier to pay off in the long run. As for the loans that do accrue interest throughout the four years of college, students are being charged more and more on a daily basis for something they can’t possibly pay off anytime soon.

Faced with this financial trap, students aren’t 100% confident about their ability to afford college. I put a sliding scale on my Instagram story asking students how confident they feel about paying for college. The left end of the scale represented low confidence and the right side represented high confidence. I received responses from Morgan seniors, seniors from other Connecticut schools, and college students. Out of 39 responses, the average level of confidence was a little below half. Nine of those were at the lowest possible end (on the far left) and 7 were at the highest possible end (on the far right).

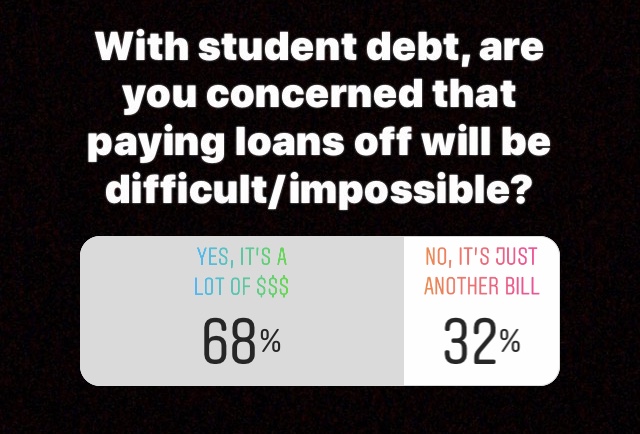

In a similar poll, I asked students their view on paying off loans in the future. Out of 77 students, 52 said that they believe paying off loans will be difficult or impossible. The other 25 students just see the monthly payment as another bill that they have to pay. The latter view, while less popular, makes plenty of sense. While there’s a student debt crisis, people do end up paying off their student loans over time despite the frustration. Of course, there are plenty of people that will fall behind in paying off loans due to economic hardship. It ultimately depends on an individual’s financial situation.

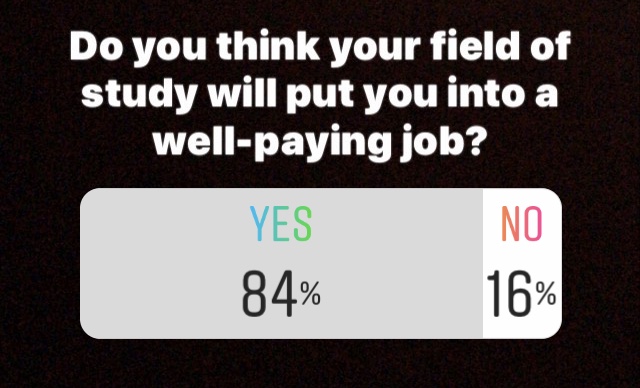

To ease this worry, plenty of students believe they are directing themselves toward a line of work that will pay off. Out of 85 students polled, 71 believe that they will land in a well-paying job based on their intended major. The other 14 students aren’t as confident about the practical application of their line of work. Even though loans are expensive, students should be in a position where they can cover them with a steady flow of income.

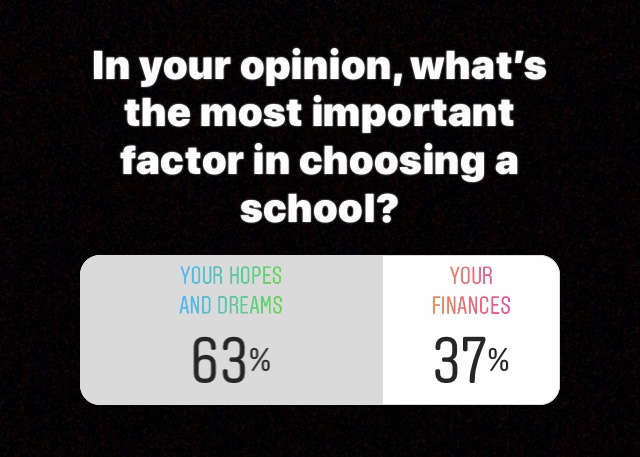

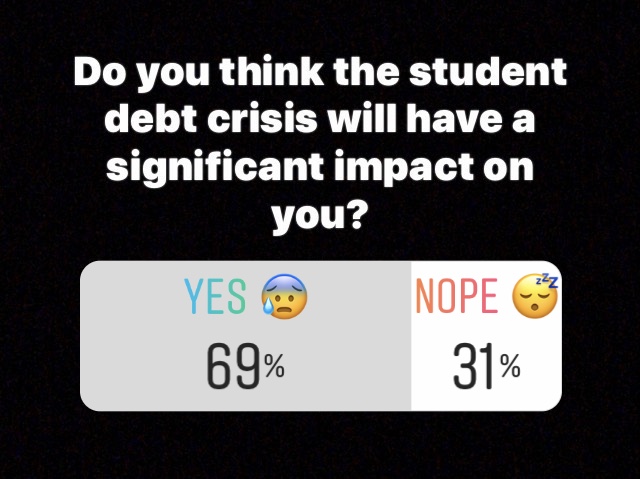

I also polled students about what they thought the most important factor in choosing a school should be, between “hopes and dreams” and finances. Out of 65 voters, 41 chose the former, and 24 chose the latter. In a subsequent poll, I asked if students expect the debt crisis to have a significant impact on them. Out of 64 votes, 44 voted “yes” and 20 voted “no.” While a majority believes that hopes and dreams should be the superior factor in determining a school, a majority also believes that they will be significantly affected by debt.

Of course, there are ways to reduce the cost of college. In filling out the FAFSA, students become eligible for financial aid offers. These include scholarships, grants, and federal loans. Morgan students have been applying for plenty of scholarships in order to lessen the cost of school, and thanks to the guidance office, options are presented to the students on Naviance. Out of 62 students polled, 24 applied for 5 or more scholarships. 7 of those students applied for between 3 and 4. While 31 (half of the voters) have applied for 2 or fewer, there are still opportunities on the guidance webpage and on a variety of other websites, including scholarships.com, unigo.com, and fastweb.com.

Unfortunately, students come into issues when applying for scholarships. I asked students some of their main struggles with the application process, and a lot of the responses were similar. Senior Isabella Recine said, “I either have other work I need to do, or I don’t have the energy.” Senior Jenna Kareliussen shared a similar issue, saying that “motivation to fill them out / essays” are a roadblock in the process. Even during quarantine, students have work to do, so finding the time and motivation to fill out scholarships can be difficult.

Senior Olivia Swan said, “I’m finding that I don’t qualify for a lot of them.” With many eligibility requirements for scholarships, including criteria based on academics, race, sex, and field of study, it’s common for students to find plenty of opportunities that don’t relate to them at all. Some students referenced their financial positions, saying that their parents make too much money for them to be eligible for certain scholarships. Since many scholarships are geared toward lower-income students, middle and upper-class families miss out on those opportunities. While such families have more money to work with than the lower class, it’s likely that they’ll be eligible for fewer loans after the expected family contribution is measured by the FAFSA. Because of this, paying for school can be just as hard for families that earn more.

Other students remarked that being away from school has made the process more difficult. Without the convenient opportunity to stroll into guidance and ask for help, and with the hassle of figuring out how to send applications, transcripts, and letters of recommendation, the process is harder on the students. Of course, remote communication with the guidance counselors is encouraged in order to make the process a bit smoother.

The Coronavirus has also led some organizations to discontinue their scholarship offers for the time being. Senior Lauren Kuever said, “a lot of the ones I had applied for are now not happening because of COVID!” Not only does that make the time spent on those applications a waste, but the pandemic eliminates some new opportunities as well. Of course, this puts the class of 2020 at a financial disadvantage. Fortunately, there are still plenty in circulation to fill out new applications. On top of that, in the coming years when this crisis has passed, the availability of scholarships will likely return to normal.

Guidance counselor Moheba Sayed has also suggested ways to reduce the cost of college: “I think maintaining a part-time job and saving your money is a good start. Also applying to as many scholarships as possible! These are little steps that can help with either out-of-pocket expenses or by making the gap in financial aid and loans a little bit smaller. “

Unfortunately, these scholarships are usually just a drop in the bucket. While they’re basically free money, they don’t usually have a huge impact on an individual’s ability to afford their expensive education. Even if a student can win $5,000 for a year, they might still need to cover beyond $40,000 for the rest of their education. On top of that, most scholarships aren’t renewable for all 4 years in college. They help, but they don’t eliminate the problem.

When students say their hopes and dreams are more important to consider than their finances, a lot of that has to do with life on campus. While community college is a cost-effective option to obtain necessary credits, students look forward to “the college experience.” Living at college and making new friends is the glamorous part of higher education, and that’s a big reason why most students choose a university where they live on campus as opposed to community college or online school.

Mrs. Sayed offered her advice on balancing the love for a school and its cost: “students should apply to the schools they are interested in, get admitted, have a financial aid package processed and then weigh that information into their decision-making process.” She also believes that students should consult with their parents in order to come to an understanding about what is affordable and possible in the realm of choosing a school.

When looking through financial aid offers, guidance counselor Myriah Rodowicz suggests that students compare packages from all the schools that accept them: “One college may appear cheaper upfront, but because they’re giving more loans and fewer scholarships or grants, they may be more expensive in the long run. Also, students should determine whether each scholarship or grant is for four years, or just for their first year. That may make a huge difference in a student’s ultimate decision.” She also encourages students to apply to schools that may not seem financially ideal at first. “We recommend students don’t avoid applying someplace due to the cost of the school because the financial aid package might be very generous, but we do recommend students have some “financially safe” schools on their list as well.”

Both guidance counselors also mentioned PACT, a new opportunity for students to receive free education at community colleges. According to Mrs. Rodowicz, “Connecticut is launching the PACT program this fall. Students who graduate from a Connecticut high school, go directly to one of Connecticut’s community colleges, and enroll in a degree bearing program will receive free tuition.” This is a great chance for students to get an associate’s degree, and it allows them to collect credits that they can transfer to another school in order to earn their bachelor’s degree.

The guidance counselors make it clear that finances are an important consideration when deciding upon a school, and while it is important how much a student likes a school, finances should not be overlooked. While students weigh their love of school as more important than finances, they would be remiss if they didn’t give it close attention nonetheless. While most seniors have already made their decision on where they are going, this is valuable advice for underclassmen who will be making decisions in a year.